My lazy Thursday morning was spurred by a posting by Stephen Foskett, Chief Organizer of Tech Field Days. “Microsoft mulls the acquisition of Mellanox”

A quick reaction leans towards a strange one. Microsoft of all people, buying a chip company? Does it make sense? However, leaning deeper, it starts to make some sense. And I believe the desire is spurred by Amazon Web Services announcement of their Graviton processor at AWS re:Invent last month.

AWS acquired Annapurna Labs in early 2015. From the sources, Annapurna was working on low powered, high performance networking chips for the mid-range market. The key words – lower powered, high performance, mid-range – are certainly the musical notes to the AWS opus. And that would mean the ability for AWS to control their destiny, even at the edge.

Willing seller, willing buyer

Microsoft, in its pursuit of AWS, would certain covet the same strategy in this cloud computing follow-the-leader game. Acquiring Mellanox Technologies would put them in a commanding position, because Mellanox is no young upstart. Mellanox is doing very well and a big reason is the burgeoning demand for deep learning and AI. Their switches and HBAs are the driving force for low latency, high throughput demands of commercial HPC applications and workloads. But strangely, there was chatter that Mellanox was putting itself up for sale back in October this year.

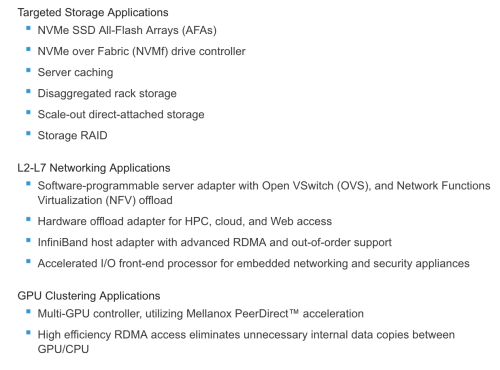

It is beginning to look like a case of willing seller, willing buyer. Microsoft has boatloads of cash, and acquiring Mellanox would not dent their cash flow. And Mellanox Bluefield SOC is definitely a desirable asset. The features of the Bluefield SOC are impressive, as show below:

The only feature I did not find from the list above is low power. I am sure with the Mellanox’s deep innovation roots, it is probably already there.

The only feature I did not find from the list above is low power. I am sure with the Mellanox’s deep innovation roots, it is probably already there.

Can it happen?

Yes, it can. Bear in mind that these news are still unconfirmed but Microsoft can certainly give Mellanox the best deal in town. And Mellanox will give Microsoft that instant market boost because they don’t have to spend a lot of investment, time and resources to see the Mellanox innovations through long, unproven gestation. It will be a brilliant acquisition.